Southeast Asian companies go premium to court Chinese consumers

Rich shoppers seen springing for imported coconut water, luxury hotels even in weak economy

IFBH, which was founded in Thailand, has become the top player in China's coconut drink market, with a 34% share as of 2024. (Photo by Kenya Akama)

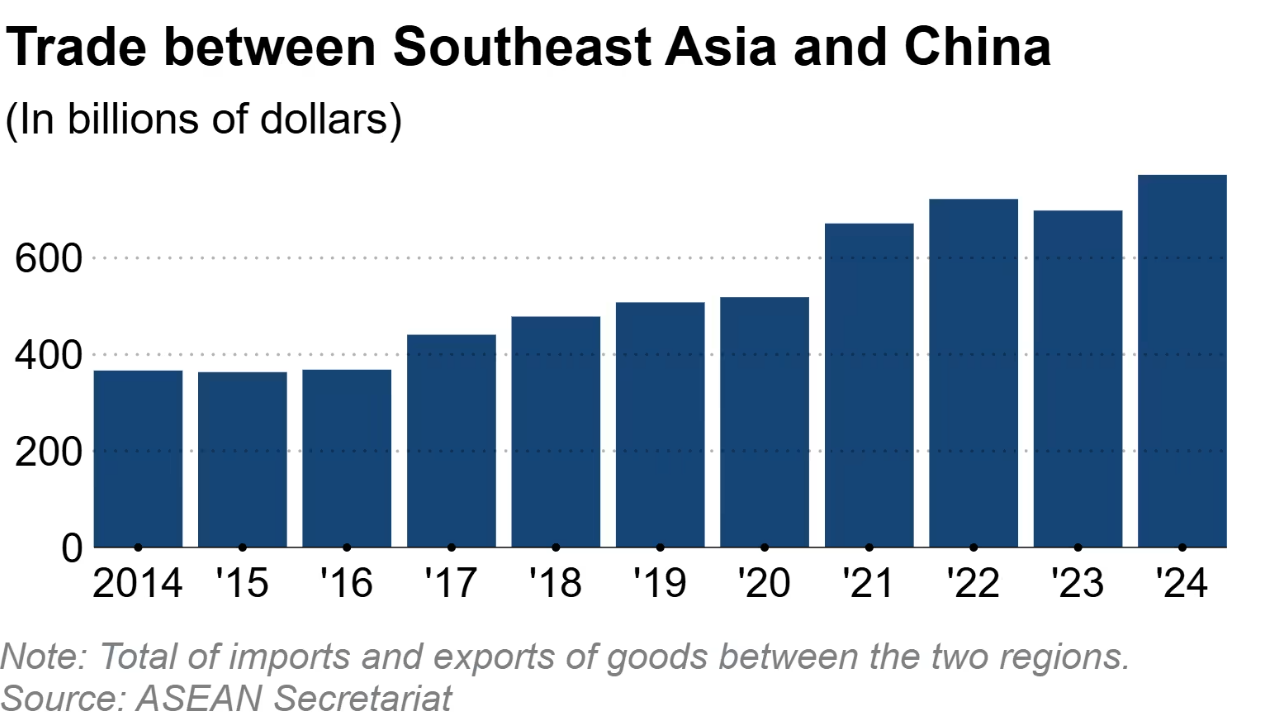

BANGKOK/GUANGZHOU -- Consumer-focused Southeast Asian companies are tapping into demand in China, finding growth despite deflationary pressure by focusing on such added value as health benefits and luxury.

The China International Import Expo in Shanghai this November saw the debut of Thai-founded IFBH, which showed off its IF coconut water and Innococo sports drinks with an emphasis on the beverages coming "from Thailand." The company announced the formation of its first mainland China subsidiary, holding a signing ceremony with local officials at the event.

Starting as a coconut water brand under the current parent company, IFBH entered the mainland market in 2017. It has since grown into the largest seller of coconut-water-related beverages there, with a 34% market share in 2024, leveraging consumers' growing focus on health since the COVID-19 pandemic. The company's global revenue jumped 80% on the year to $157.64 million in 2024, with 97% coming from China and Hong Kong.

A 350-milliliter bottle of IF coconut water goes for around 9 yuan ($1.27) at convenience stores in Guangzhou. Although it is often pricier than local brands, online reviews praise its sweetness and the trustworthiness of its ingredients.

"It tastes almost like actual coconut," a Guangzhou resident in his 20s said.

To further cultivate markets in greater China, IFBH listed on the Hong Kong stock market in June, raising 1.16 billion Hong Kong dollars ($149 million). It announced in September a tie-up with an affiliate of China's state-owned COFCO, extending the reach of its drinks to more than 1 million retail locations and vending machines across more than 200 cities in China.

IFBH founder and CEO Pongsakorn Pongsak said, "We can be a platformer to help Thai companies to get their food and beverage business bigger in China."

He said that while there is deflationary pressure in China, "there are many tiers of consumers in China," adding that consumers who purchase imported products like coconut water are at the "top of the pyramid [with] a lot of buying power."

Southeast Asian hotel companies are also setting their sights on China. Minor International, one of the region's top players, plans to expand its presence there from four hotels to 15 within the next few years, opening locations in such areas as the tourism hot spot of Qiandao Lake in Zhejiang province. Singaporean hotel and resort company Banyan Group had 14 destinations in its Chinese pipeline at the end of 2024.

Southeast Asian businesses have eyed the Chinese market for years, but the initial focus was on agricultural and industrial products. Thai conglomerate Charoen Pokphand and Malaysia's Kuok Group entered around 1980 amid China's "reform and opening-up" pivot.

In the 2010s, the growth of the Chinese middle class drew such consumer-related companies as top retailer Central Group and canned-tuna maker Thai Union. But ferocious price competition forced many to withdraw or scale back.

The likes of IFBH and Minor are seen by some as a third wave, focusing more than their predecessors on high-income consumers and products with added value.

Although the persistent slump in China's real estate market has made consumers thriftier for now, demand is expected to grow in such areas as health care and leisure over the medium to long term, and these businesses look to establish a foothold early.

"The Chinese market as a whole is tough because of deflationary pressure, so it's important to narrow your strategy to 'premium' or 'niche'" offerings, said Shuhei Hashimoto of Roland Berger.